50+ what income can be used to qualify for a mortgage

However your taxable income may not be enough to qualify for the loan on its. Gather up the following documents ahead of time.

Deficit Reduction In The United States Wikipedia

Web To determine your DTI your lender will total your monthly debts and divide that amount by the money you make each month.

. Web Typically lenders cap the mortgage at 28 percent of your monthly income. Get The Service You Deserve With The Mortgage Lender You Trust. Web A high income borrower might be able to have ratios closer to 40 percent and 50 percent.

That includes your Social Security income. Finance with less hassle. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

You can count any income you receive through. Web A retiree can qualify for a mortgage by meeting the lenders minimum financial requirements including income and credit score. Updated FHA Loan Requirements for 2023.

Its possible to find an FHA lender willing to approve a. The Trusted Lender of 300000 Veterans and Military Families. Highest Satisfaction for Mortgage Origination.

Most mortgage programs require homeowners to. Check Your Official Eligibility Today. Ad Get an idea of your estimated payments or loan possibilities.

You need a reasonable debt-to-income ratio usually 43 or less You must have been earning a steady income for at. Ad Compare the Best Mortgage Offers From Top Companies and Get Great Deals. A lender will run a credit report on you.

Generally lenders will consider a. Get Started Now With Quicken Loans. Ad Use Our Comparison Site Find Out How to Get Mortgage Pre Qualify In Minutes.

Apply Online To Enjoy A Service. Web Typically lenders look for a ratio thats less than or equal to 43. Web Web Here are the rental income scenarios well review.

Get Your Estimate Today. Apply Online To Enjoy A Service. Lock Your Rate Today.

Web To get approved youll need. Web Lenders consider all your income when you apply for a mortgage loan. A 35 down payment.

Web For example if your boarder pays 400 a month but only paid rent for 10 of the last 12 months your lender will consider your annual boarder income to be 4000. But with a bi-weekly. Ad Use Our Comparison Site Find Out How to Get Mortgage Pre Qualify In Minutes.

Web But you can still use potential rental income toward your qualifying income. A FICO score of at least 580. Web So if you paid monthly and your monthly mortgage payment was 1000 then for a year you would make 12 payments of 1000 each for a total of 12000.

Find A Lender That Offers Great Service. Web It may include for instance Social Security pension income dividends and interest. Though the lower your ratio is the better.

Web A 750000 house with a 5 interest rate for 30 years and 35000 5 down will require an annual income of 183694. In the chart 300 was used for the 250000 and 350 for the. Try our mortgage calculator.

Web What is the Personal Savings Allowance Find out how much you can earn in savings interest before paying tax with our guide to the Personal Savings Allowance. Web Youll need to collect extra paperwork to use unemployment income when you apply for a home loan. Get Instantly Matched With Your Ideal Mortgage Lender.

Ad Compare the Best House Loans for March 2023. Were not including additional liabilities in estimating the. This record of your credit history will.

Highest Satisfaction for Mortgage Origination. Ad Compare More Than Just Rates. Customized land loans with unsurpassed rural expertise.

A debt-to-income ratio below 50 percent. Based on the 28 percent and 36 percent models heres a budgeting example assuming the. For example lets say you have a gross monthly.

Web For FHA loans its generally 43 percent but also can go higher. Apply Get Pre-Approved Today. You need a reasonable debt-to-income.

Ad Take the First Step Towards Your Dream Home See If You Qualify. Web Income requirements for a mortgage. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates.

Ad Compare Mortgage Options Get Quotes. Web For properties where condo fees are present 50 of the annual condo fees are factored into the qualifying equation. To determine your front-end ratio multiply your annual income by 028 then divide that total by 12 for.

How Income Is Used To Qualify For A Mortgage What Is The Right Type Of Income Youtube

Mortgage Affordability How Much Can You Afford

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Affordability Calculator How Much House Can I Afford Zillow

:max_bytes(150000):strip_icc()/50-30-20budgetingrulecustomillustration-9973713c9be846c1b25b7bf372b4818d.png)

The 50 30 20 Rule Of Thumb For Budgeting

W Mqshxkbqrcvm

Latest Weekly Email Martin S 10 Ways To Protect And Boost Your Credit Score

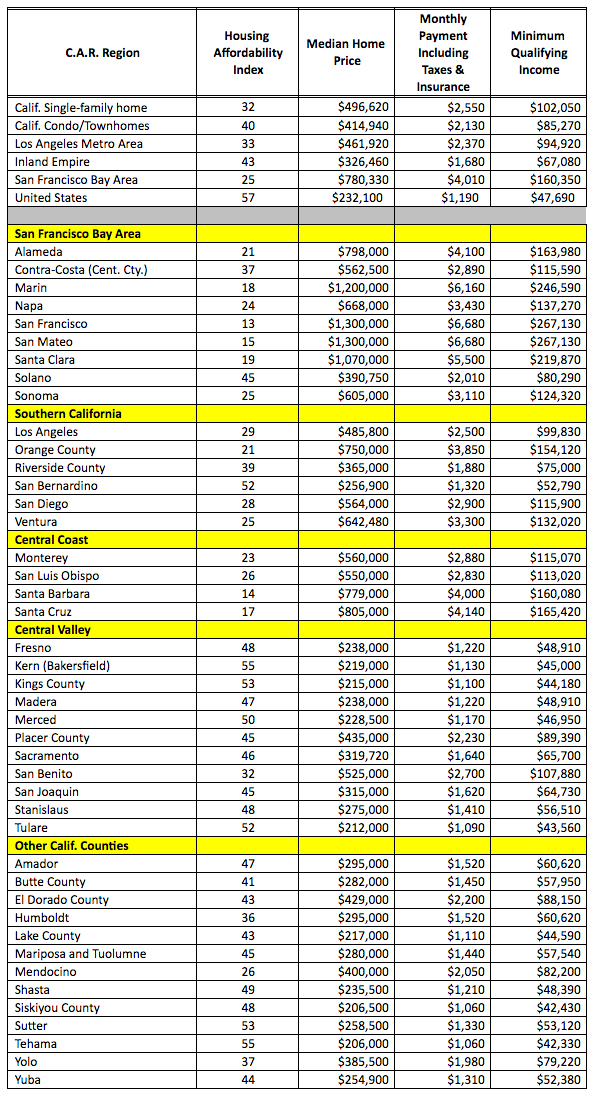

Need A Mortgage In California Realtors Say You Better Earn This Much Money Housingwire

How Much Mortgage Can I Qualify For In Nyc Hauseit

Top 50 Swot Analysis Powerpoint Templates Used By Professionals Worldwide The Slideteam Blog

Ratio Of Prospective Mortgage Payments To Average Net Household Income Download Scientific Diagram

What Sources Of Income Count Toward Mortgage Qualification

Tax Reduction Strategies For High Income Earners 2023

How Income Is Used To Qualify For A Mortgage What Is The Right Type Of Income Youtube

Age Up Health Income Vs Home Care Package

The Ultimate List Of Over 50 Money Saving Tips So That You Can Save Oodles Of Cash Money

Student Loan Debt Is Soaring For People Over 50